michigan gas tax rate

Gas tax is different for gasoline diesel aviation fuel and jet fuel. Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles.

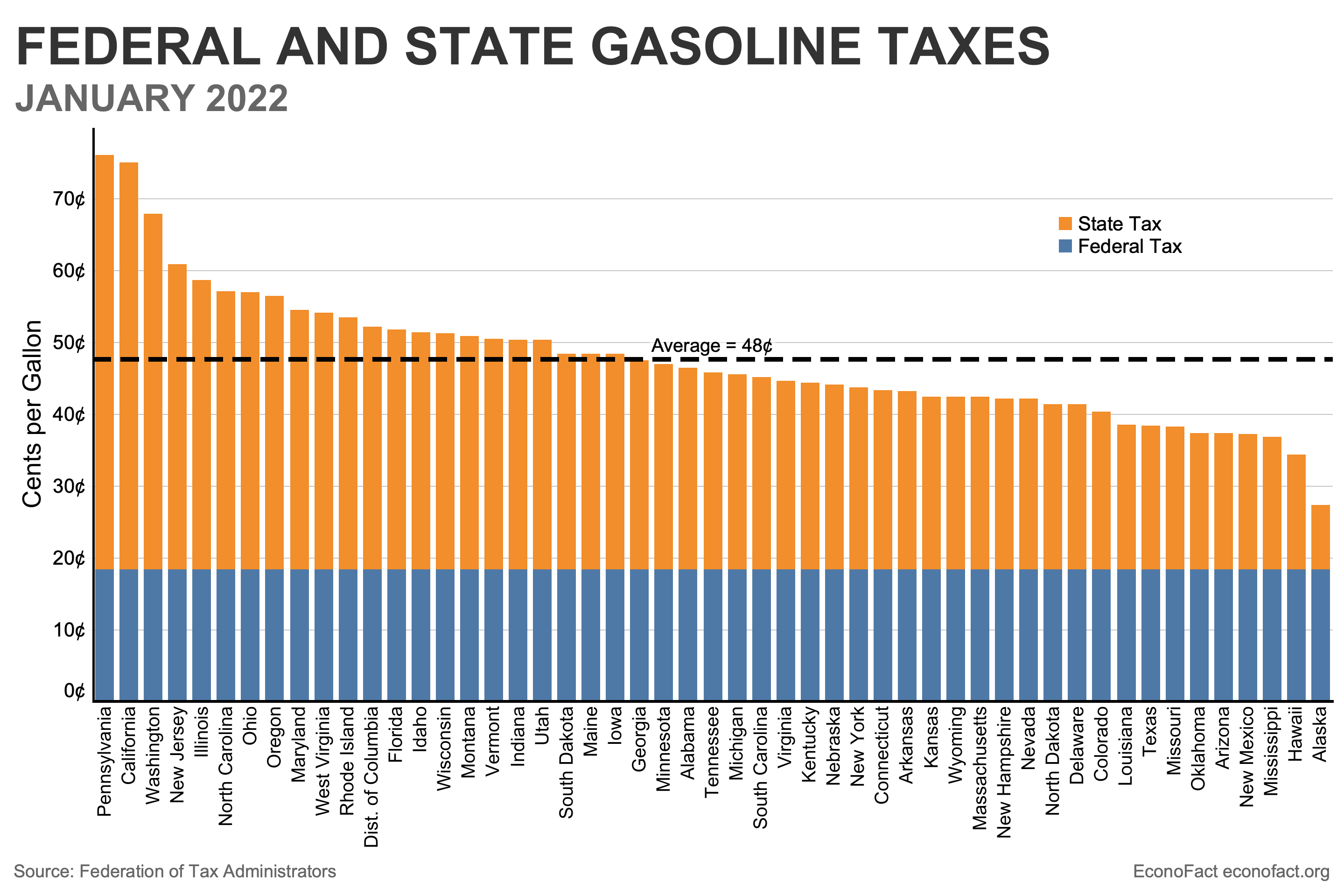

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

As of January of this year the average price of a gallon of gasoline in Michigan was.

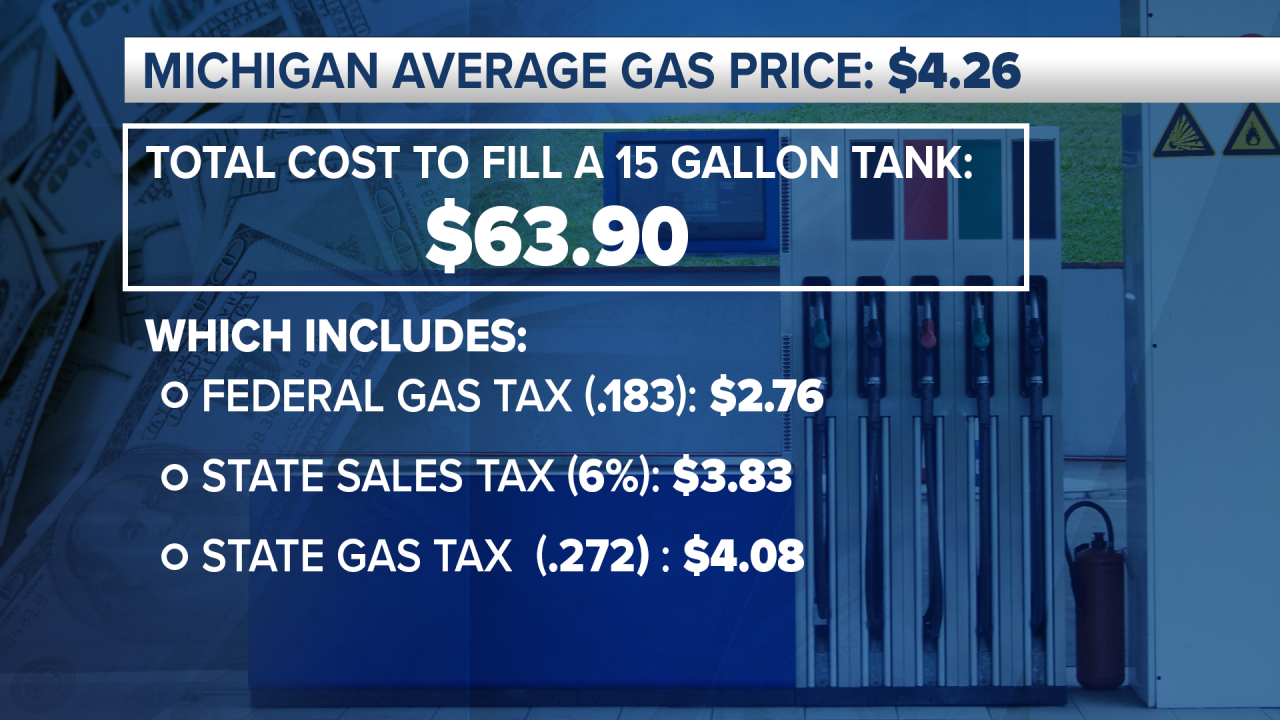

. Gasoline 263 per gallon. Michigan severance tax returns must be filed monthly by the 25th of the month following the production. Michiganders are also subject to a 6 state sales tax on gasoline as well as the federal gas tax at 184 cents per gallon.

Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. In the United States the federal motor fuel tax rates are. An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon.

The Michigan State Senate voted 36-1 last Thursday on bills that would suspend the states gas taxes for a three-month period as prices at the pump still remain high. For fuel purchased January 1 2017 and through December 31 2021. The fuel was used on a farm for farming purposes in carrying on a trade or.

How does the Michigan gas tax work. Compressed Natural Gas CNG 0184 per gallon. The user-pays principle the idea that the people who use transportation infrastructure should fund it through paying taxes justifies such a scheme.

The Department has set the current rate at 33. According to AAA the state. Gretchen Whitmer vetoes it.

Gretchen Whitmer is urging President Joe Biden and Congress to temporarily pause the federal gas tax amid high prices at the pump. This legislation would. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST.

263 cents per Michigan motor fuel tax. The current federal motor fuel tax rates are. Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers.

There are three gas taxes in Michigan. Diesel Fuel 272 per gallon. Gasoline 272 per gallon.

7521 Westshire Drive Suite 200. 26 rows Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale. That includes a roughly 1.

0219 gallon Most jet fuel that is used in commercial transportation is 044gallon. Michigan House lawmakers approved a Republican-backed plan 63-39 Wednesday to suspend the states 272 cent-per-gallon gas tax for six months a move aimed to provide tax relief for motorists. It will remain in place until at least the end of the year.

The legislation requires Michigans Department of Treasury to increase tax rates concomitant to inflation. For fuel purchased January 1 2022 and after. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an.

CBS DETROIT Michigan Gov. The same three taxes are included in the retail price on. Natural gas prices as filed with the Michigan Public Service Commission.

The Michigan gas tax is included in the pump price at all gas stations in Michigan. Diesel Fuel 263 per gallon. Per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon.

If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in Michigan sales tax. According to AAA the state. 120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents.

How a rate review works. 1 unless Democratic Gov. Information on natural gas service and rates for residential customers in Michigan.

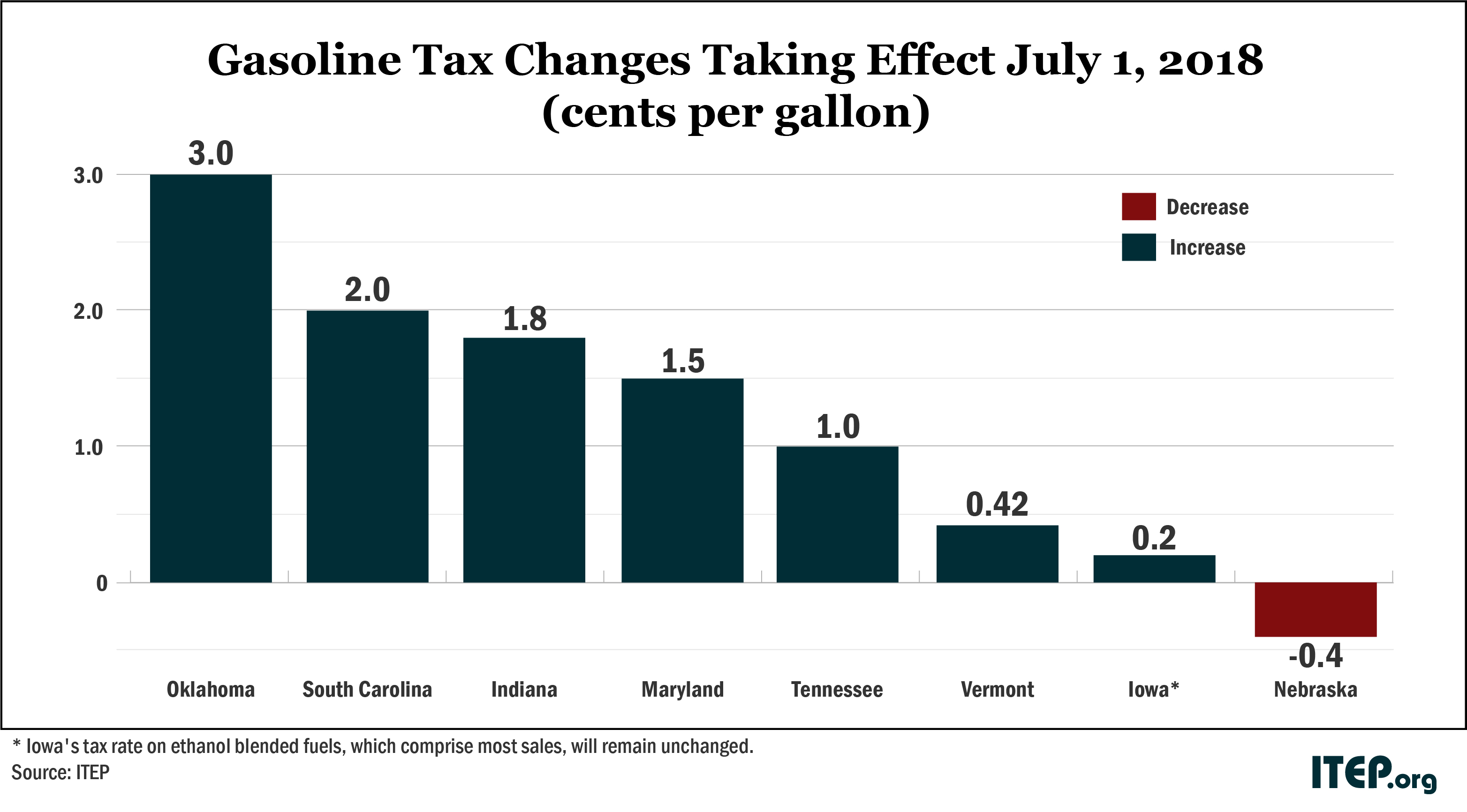

Lawmakers have faced pressure to rescind Michigans 27-cent-per-gallon tax rate on all types of fuel as gas prices have soared in recent months. 0244gallon aviation fuel tax. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St.

Tom Barrett R-Charlotte said charging the states 6 sales tax on fuel is having an outsized impact. That ranks Michigan as the 10th highest tax per gallon of gas in the nation. These tax rates are based on.

A gas tax or fuel tax is an excise tax imposed on the sale of fuel. 0194gallon and jet fuel tax. Thats 062 in taxes for each gallon of gas at the average.

What is Michigans gas tax now. FEDERAL AND STATE FUEL EXCISE TAX EXEMPTIONS. Michigan gas tax rate Friday March 18 2022 Edit.

Michigans excise tax on gasoline is ranked 17 out of the 50 states. The bill expected to earn approval from the GOP-controlled Senate next week would take effect Apr. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states.

The state tax of 272 cents per gallon the federal tax of 184 cents per gallon and the state gas sales tax of 6 percent per gallon. Alternative Fuel which includes LPG 263 per gallon. Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation.

This tax is established in the Motor Fuel Tax Act 2000 PA 403. As working-class families middle class families and small businesses are paying more in fuel the government is actually getting richer by that action because the cost goes up and they recoup more as a percentage of that. Diesel is 280 cents per gallon.

If a gallon of gas at the pump sells for 256 cents then 22 of the price is composed of federal and state taxes. 55 rows Gasoline is 235 cents per gallon. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Notice of Prepaid Sales Tax. This would bring your total gas tax bill to 617 cents per gallon. Michigan drivers pay 42 cents per gallon in state gas taxes.

Michigan natural gas rates.

Michigan Gasoline And Fuel Taxes For 2022

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

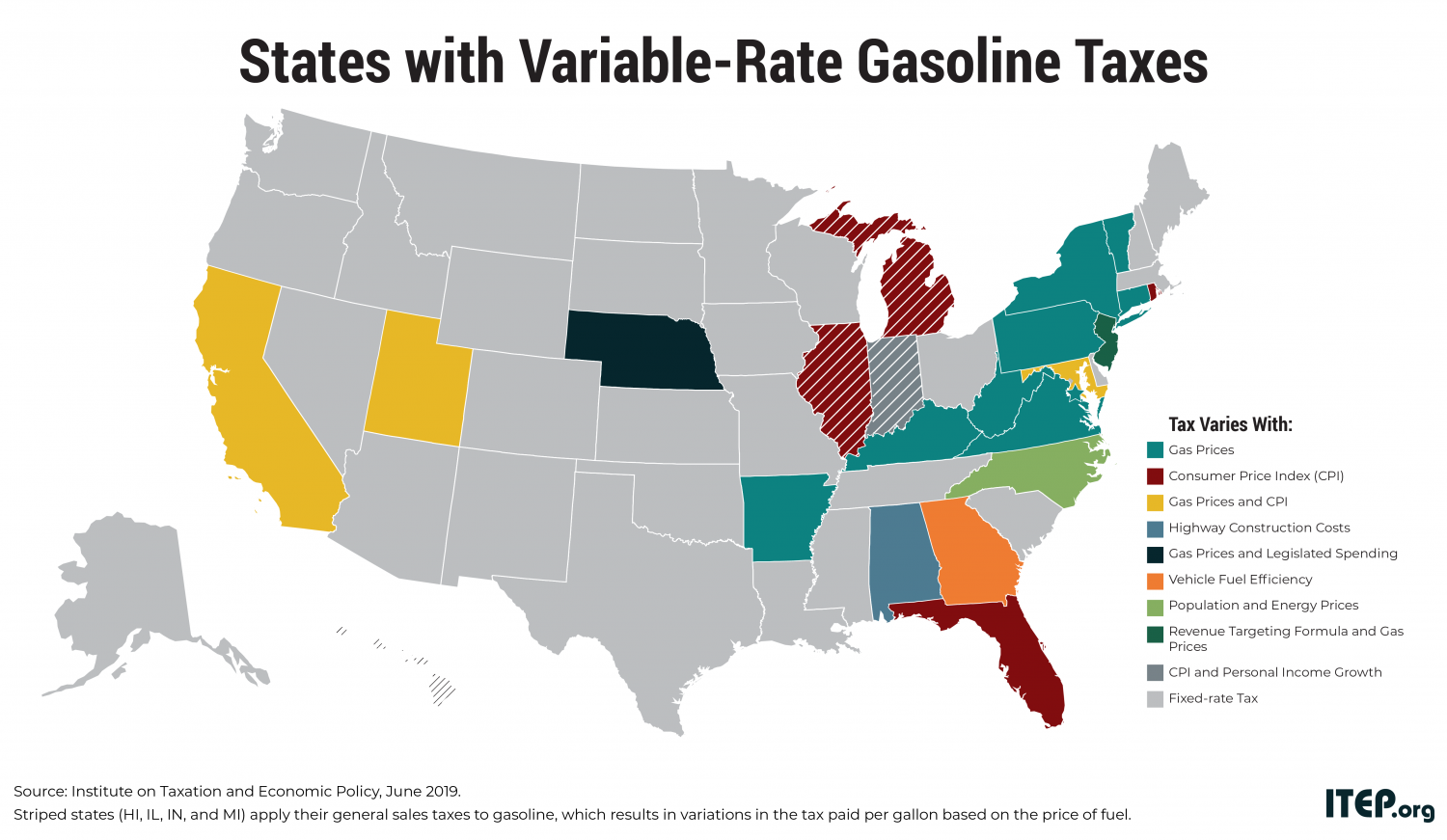

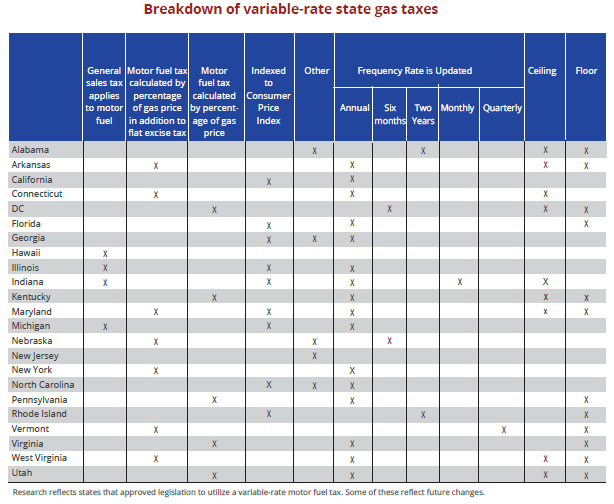

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Michigan Senate Passes Fuel Tax Pause Bills

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Michigan Senators Seek Summer Pause On Gas Taxes Gov Gretchen Whitmer Encouraged Bridge Michigan

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Most Americans Live In States With Variable Rate Gas Taxes Itep

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Michigan Gas Tax Calculator Michigan Petroleum Association

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump